What is PSD2?

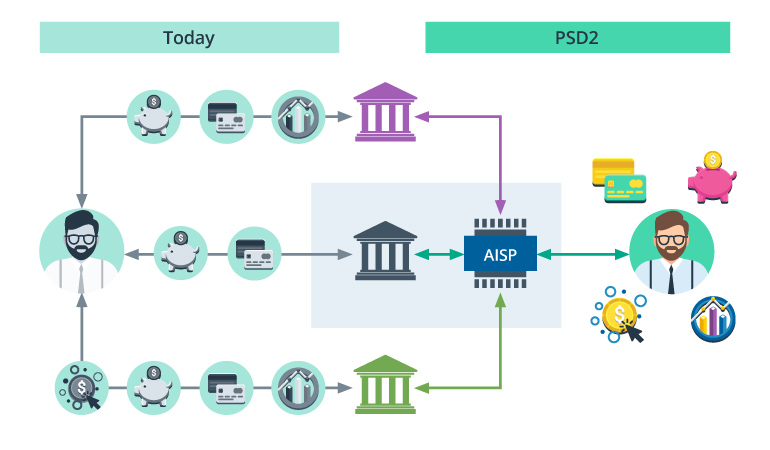

PSD2 is a European regulation for electronic payment services. It seeks to make payments more secure in Europe, boost innovation and help banking services adapt to new technologies. PSD2 is evidence of the increasing importance Application Program Interfaces (APIs) are acquiring in different financial sectors.

It all began in 2007, with the Payment Service Providers Directive (PSD), which sought to contribute to the development of a single payment market in the European Union to promote innovation, competition and efficiency in the EU.

In 2013, the European Commission proposed an amendment (that’s where the two comes from in PSD2), which aimed to enhance these objectives. It seeks to improve consumer protection, boost competition and innovation in the sector and reinforce security in the payments market, which is expected to facilitate the development of new methods of payment and ecommerce.

How to use the PSD2 API?

API Gateway documentation

Go through the documentation which describes in detail how to access the PSD2 APIs.

Browse the available APIs

Take a look at our APIs to see what choices are available. Is there an API you can exploit in one of your applications?

Use the supplied APIs to quickly construct a fully featured application.

Enrollment - Upload your certificate

you can use production certificates (QWAC & QSealC), or generate test certificates from this site.

Start Using The Sandbox

The following endpoint is used to get access to the PSD2 APIs of the bank in the sandbox.

https://OpenBankingXS2AAPI-SandBox.lb.ge/

Password: demo

OTP: 1234